How to calculate the pip value of your forex trades. The pip value helps to determine your potential profit or loss per pip of movement in a currency pair’s price. The process for calculating pip value depends on how you’re trading: For CFDs, you want to multiply one pip () by the position size 3/5/ · How to calculate a pip value in forex? To calculate the pip value, divide one pip (usually for major currencies) by the currency pair’s current value. In the next step, multiply that number by your lot size: the number of base units you are trading. For example, if the exchange rate is , trading size 1 lot and currency pair EURUSD, then: Pip Value = (Pip x Trade Size) / Exchange Rate= 18/1/ · A “PIP” – which stands for Point in Percentage - is the unit of measure used by forex traders to define the smallest change in value between two currencies. This is represented by a

How to Calculate a Pip Value? - Forex Education

Pip and pips are widespread terms in the trading industry. In this article, we will explain the basic concept. A forex pip is the lowest price increase for a given pair, 1 forex pip. The pip value is a unit of measurement 1 forex pip currency movement in most currency pairs in the forex trade.

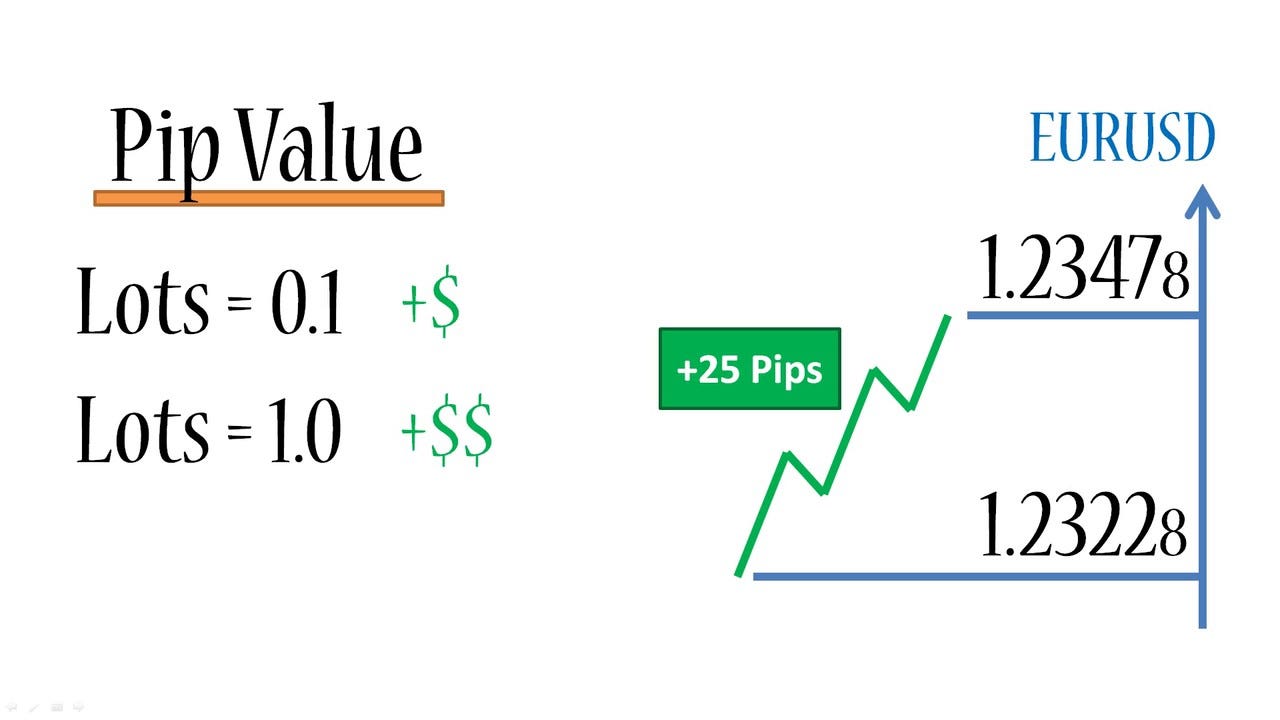

The pip between two currencies varies. However, it is generally equal to the fourth decimal place in most currency pairs. For EURUSD or GBPUSD, for example, 0. The pip value, as you know, is the standard by which a currency pair is compared. This also includes the exchanges of the currency pairs as well as the trade size, 1 forex pip.

The significance of pip value is that through pip, you can show the amount of exposure and significantly influence your position.

If you want to learn how to count pips in the MT4 platform for various symbols visit our article. Currency must be exchanged to enable international transactions. There are a lot of bets and other transactions happening in the forex market.

All these take place via speculators who are on the watch-out to earn money as the price of foreign currency moves. To calculate pip 1 forex pip in the forex pair, you need to count the decimal places where the last decimal place represents 1 pip difference.

For example, 1 forex pip, EURUSD currency pair exchange rate 1, 1 forex pip. From 1 forex pip. However, some currency pairs like USDJPY have 1 pip value of 0. For example, from To calculate the pip value, divide one pip usually 0. In the next step, multiply that number by your lot size: the number of base units you are trading.

For 1 forex pip, if the exchange rate is 1. To make it simple, each forex account will have a certain number of lots and pips. And the pip the lowest amount that currency can change, 1 forex pip.

The value of a foreign currency keeps on varying concerning other currencies, 1 forex pip. And, the absolute value varies with different currencies and with a particular currency. The pip shows to what extent a pair of currencies move up and goes down. The value of a pip is, therefore, varies across pairs of currencies, 1 forex pip. This article discusses pip value and the various aspects that go into calculating the pip value. Likewise, when the price increases or decreases 0.

What are 20 pips meaning in the forex market? For example, when EURUSD rises from 1. What are 10 pips meaning in the forex market? What are 30 pips meaning in the forex market? What are 50 pips meaning in the forex market?

There are a few currency pairs that are expressed in terms of the second digit following the decimal. Using this pip difference calculator aboveyou can calculate the Eurgbp pip value, Eurusd pip value, Usdchf pip value, etc.

So far, we have defined a pip in forex as the lowest incremental variation in the currency pair price. For this reason, each trader must know the way the pip of the forex currency pair is determined.

This helps the currency to gain currency and risk management. The formula to calculate pip value in USD trading account or non JPY account is : 0. The most traded currency in the international currency 1 forex pip is the US dollar. When the US dollar is listed second in a pair, the pip value is constant and does not have an account financed in USD.

It is not that many currencies are being traded in your forex account. We will explain how to determine the pip for pairs that are not included in your currency account. As you know, 1 forex pip, the second currency is constant if you had an account in that currency, 1 forex pip. Make sure to consider the current is proved the pip value: the second currency. Once you know the value, you can determine pip in the particular currency to your desired currency.

These pip values are coterminous, 1 forex pip, where USD is listed second. Profitability, in turn, is determined by the quality of your judgment and foresight. For all this, you need to keep abreast of the market: 1 forex pip PIP value of the currency pair and the general market condition around. Thus, to realize the best result, calculating a pip value is important, and you need to leverage it.

Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us. What is a pip in forex 1 forex pip Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all.

Capital Gains Tax Rate What is Quadruple Witching? What Does Quarterly Mean? Related posts: How to Calculate Lot Size in Forex? How to Count Pips? Calculate Crude Oil Lot Size — How 1 forex pip Read Oil Pips How to Calculate Pips on Silver? How to Calculate Risk Reward Ratio in Forex How Many Pips Does Eurusd Move Daily What is Forex and How Does it Work?

Swap Points — Swap rate calculation forex example How Many Currency Pairs in Forex? Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Account Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in forex?

Are PAMM Accounts Safe? Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us. Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

TRADING: CAN YOU MAKE 1 PIP?

, time: 10:09What is a Pip? Using Pips in Forex Trading

24/3/ · The “pip value” of a given trading position is its change in value due to a one-pip move in the relevant foreign exchange rate, all other factors remaining equal. The currency that a pip’s value is 3/5/ · How to calculate a pip value in forex? To calculate the pip value, divide one pip (usually for major currencies) by the currency pair’s current value. In the next step, multiply that number by your lot size: the number of base units you are trading. For example, if the exchange rate is , trading size 1 lot and currency pair EURUSD, then: Pip Value = (Pip x Trade Size) / Exchange Rate= What is a Forex Pip? How Much is a Forex Pip Worth? Manually Calculating Pip Value. In this article, Base currency refers to the first currency in a pair ie EUR in EURUSD and quote currency refers to the second ie USD. TO CALULATE: 1) If account is denominated in USD and USD is the quote currency (EURUSD): Pip Value = x Units

No comments:

Post a Comment