This article discusses why candlestick trading is an ideal way to trade binary options. Viewing price action in the form of Japanese candlesticks was popularised by Steve Nison. Candlesticks are now the default view in most trading software and glancing at a chart shows why Binary Options Trading with Candlesticks. Here you will learn how to trade binary options by using candlesticks charts. Trading binary options is classified as gambling by many countries, but the truth is that trading binary options rarely involves luck. With the help of technical and fundamental analysis, you can accurately predict how an asset’s This can be highly valuable information for binary options trades, as candlestick patterns can give a great deal of information when forecasting price direction. This is critical for knowing when a trader should enter into a CALL or a PUT, so here we will look at some of the ways candlesticks are interpreted and at some of the most commonly used patterns so that these signals can be used in trading

Binary Options Candlestick Charts | How To Use Candlesticks For Trading

Candlestick charts are perhaps the most popular trading chart. With a wealth of data hidden within each candle, the patterns form the basis for many a trade or trading strategy. Here we explain the candlestick and each element of the candle itself. Then we explain common candlestick patterns like the doji, hammer and gravestone. Beyond that, we explore some of the strategy, and chart analysis with short tutorials.

Reading candlestick charts provides a solid foundation for technical analysis and winning binary options strategy. Japanese Candlesticks are one binary options trading strategy with candlesticks the most widely used chart types. The charts show a lot of information, and do so in a highly visual way, binary options trading strategy with candlesticks, making it easy for traders to see potential trading signals or trends and perform analysis with greater speed. Binary options trading strategy with candlesticks new traders are excited because they have some good results in the beginning by candlestick patterns without spending much time reading about trading, but in the long run they fail and they come back to learn more.

Candlestick patterns are a good tool, but only for confirmation. Of course every trader should know how to read the candles. If you know how to read the candles properly, you can use them for confirmation in your trades — but first you must know the basics. Japanese Candlesticks are a type of chart which shows the high, low, open and close of an assets price, as well as quickly showing whether the asset finished higher or lower over a specific period, by creating an easy to read, simple, interpretation of the market.

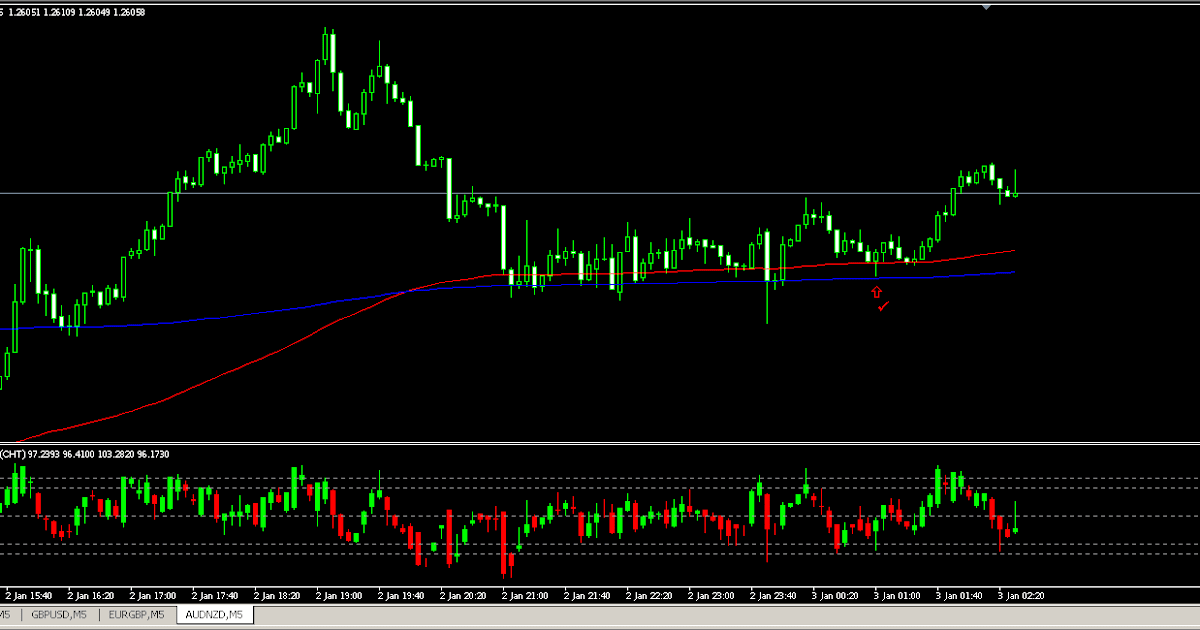

Candlesticks can be used for all time frames — from a 1 minute chart right up to weekly and yearly charts, and have a long and rich history dating back to the feudal rice markets of ancient Samurai dominated Japan. When information is presented in such a way, it makes it relatively easy — compared to other forms of charts — to perform analysis and spot trade binary options trading strategy with candlesticks. As indicated, each candle provides information on the open, close, high and low of an assets price.

Each reflects the time period you have selected for your chart. For example, if a 5 minute chart was used each candle shows the open, close, high and low price information for a 5 minute period.

When 5 minutes has elapsed a new 5 minute candle starts. The same process occurs whether you use a 1 minute chart or a weekly chart. This is binary options trading strategy with candlesticks the real body, and represents the difference between the open and close. If the close is higher than the open, the candle will be green or white; if the close is lower than open the bar will be red or black but other colors can often be found on different charts.

The open or close are not necessarily the binary options trading strategy with candlesticks or low price points of the period though. If there are no upper or lower shadow it means the open and close were also the high binary options trading strategy with candlesticks low for that period which in itself is a kind of signal of market strength and direction.

These are called dojis and have special meaning, binary options trading strategy with candlesticks, a market in balance, and often give strong signals. Due to the highly visual construction of candlesticks there are many signals and patterns which traders use for analysis and to establish trades.

What many traders fail to pay attention to is the tails or wicks of a candle, binary options trading strategy with candlesticks. They mark the highs and lows in price which occurred over the price period, and show where the price closed in relation to the high and low, binary options trading strategy with candlesticks.

But on some days, as when the price is trading near support or resistance levels, or along a trend line, or during a news event, a strong shadow may form and create a trading signal of real importance, binary options trading strategy with candlesticks. If there is one thing that everyone should remember about the candle wicks, shadows and tails is that they are fantastic indications of support, resistance and potential turning points in the market.

To illustrate this point lets look at two very specific candle signals that incorporate long upper or lower shadows. The hammer is a candle that has a long lower tail and a small body near the top of the candle. It shows that during that period whether 1 minute, 5 minute or daily candlesticks that price opened and fell quite a distance, but rallied back to close near above or below the open.

But they are significant when a long lower tail—hammer—is seen near support. It indicates the sellers tried to push the price through support but failed, and now the buyers are likely to take price higher again. The thing to remember here is that a hammer could indicate a new area of support as well. Three candles, all with long tails occurred in the same price area and had very similar price lows.

That three long tailed candles all binary options trading strategy with candlesticks the same area showed there was strong support at It shows that during the period whether 1 minute, 5 minute or daily candlesticks that price opened then rallied quite a distance, but then fell to close near above or below the open. This is sign that sellers stepped into a hot market and created a graveyard for the buyers. Long upper tails are seen all over the place, and are not significant on their own.

But they are significant when a long upper tail—gravestone—is seen near resistance, unless of course a new resistance level is being set. It indicates the buyers tried to push the price through resistance but failed, and now the sellers are likely to take price lower again. The price tested this resistance area multiple times, finally it broke above it, but within the same bar one hour the price collapsed back. The price did proceed lower from there.

Look for them on candles, they are important. Multiple long tails in one area, like in figure 1, show there is a support or resistance there, binary options trading strategy with candlesticks. A hammer opens and closes near the top of the candle, and has a long lower tail. A gravestone opens and closes near the bottom of the candle, and has a long upper tail.

The next thing to look out for is the doji, a candle that combines traits of the hammer and gravestone into one powerful signal. Dojis are among the most powerful candlestick signals, if you are not using them you should be. Candlesticks are by far the best method of charting for binary options and of the many signals derived from candlestick charting dojis are among the most popular and easy to spot.

There are several types of dojis to be aware of but they all share a few common traits. First, they are candles with little to no visible body, binary options trading strategy with candlesticks, that is, the open and closing price of that sessions trading are equal or very, binary options trading strategy with candlesticks, very close together.

Dojis also tend to have pronounced shadows, either upper or lower or both. These traits combine to give deep insight into the market and can show times of balance as well as extremes. In terms of signals they are pretty accurate at pinpointing market reversals, provided you read them correctly. Like all signals, doji candles can appear at any time for just about any reason. It takes other factors to give the doji true importance such as volume, size and position relative to technical price levels.

Truly important dojis are rarer than most candle signals but also more reliable to trade on. Here are some things to consider. First, how big is the doji. If it is relatively small, as in it has short upper and lower shadows, it may be nothing more than a spinning top style candle and representative of a drifting market and one without direction.

If however the doji shadows encompass a range binary options trading strategy with candlesticks than normal the strength of the signal increases, and increases relative to the size of the doji. Candles with extremely large shadows are called long legged dojis and are the strongest of all doji signals. One of this type appearing at support may be a shooting star, pin bar or hanging man signal; one occurring at support may be a tombstone or a hammer signal. Look at the example below.

There are numerous candles that fit the basic definition of a doji but only one stands out as a valid signal. This doji is long legged, appears at support and closes above that support level. Another confirming indication that a doji is a strong signal and not a fake one is volume. The higher the volume the better as it is an indication of market commitment. In respect to the above example it means that price has corrected to an extreme, and at that extreme buyers stepped in.

It also means that near term sellers have disappeared, or all those who wanted to sell are now out of the market, leaving the road clear for bullish price action. A doji confirming support during a clear uptrend is a trend following signal while one occurring at a peak during the same trend may indicate a correction.

The same is true for down trends. Failing to account for trend, or range bound conditions, can be the difference between a profitable entry or not. The below demo video, explains how to configure a robot using the builder feature at IQ Option. The video explain how to specifically setup a strategy based on candlesticks, and doji patterns within them.

In the example above a call option is clearly the correct thing to do but if purchased at the close of the doji, it could easily have resulted in a loss. The doji shows support like sonar shows the bottom of the ocean but that does not mean a reversal will happen immediately. The best thing to do is to wait for at least the next candle and target an entry close to support. This same is true for resistance as well. Expiry will be your final concern.

This is a very apt saying that simply means getting caught up in the small things and not seeing the bigger picture. This can happen all to often when trading and is especially common among newer traders. Candlesticks, and candlestick charting, are one of the top methods of analyzing financial charts but like all indicators can provide just as many bad or false signals as it does good ones. For that reason alone it is a good idea to filter any candle signal with some other indicator or analysis.

I like them because they offer so much more insight into price action. Switching from a line chart to an O-H-L-C chart to a candlestick chart is like bringing the market into focus. The candles jump off the chart and scream things like Doji, Harami and other basic price patterns that can alter the course of the market.

The thing is, these patterns can happen everyday. Which ones are the ones you want to use for your signals?

That is the question on the mind of any one who has tried and failed to trade with this technique. Look at the chart below; a new candle forms every day. Some day a bullish candle, some days a bearish one, binary options trading strategy with candlesticks, some times two or more days combine to form a larger pattern.

Look at the chart below, binary options trading strategy with candlesticks. I have marked 8 candle patterns widely used by traders that failed to perform as expected. Why is this you may ask yourself? It all comes down to where the signals occur relative to past price action.

BINARY OPTIONS STRATEGY 2020: ☑️ Candlesticks Analysis ☑️ 100% Strategy ✅ Price Action ✅ S\u0026R Power ✅

, time: 11:17Binary Options Trading with Candlesticks

This article discusses why candlestick trading is an ideal way to trade binary options. Viewing price action in the form of Japanese candlesticks was popularised by Steve Nison. Candlesticks are now the default view in most trading software and glancing at a chart shows why This can be highly valuable information for binary options trades, as candlestick patterns can give a great deal of information when forecasting price direction. This is critical for knowing when a trader should enter into a CALL or a PUT, so here we will look at some of the ways candlesticks are interpreted and at some of the most commonly used patterns so that these signals can be used in trading Doji Strategy for Binary Options. Dojis are among the most powerful candlestick signals, if you are not using them you should be. Candlesticks are by far the best method of charting for binary options and of the many signals derived from candlestick charting dojis are among the most popular and easy to spot

No comments:

Post a Comment