Forex has the higher leverage provided, meaning that you need a smaller account to trade. It’s a good option if you have limited resources. Stocks require the most amount of margin to trade, so you need a bigger account to trade stocks. This is especially true for day trading. Indices are between forex and stocks /01/25 · Let's take a look at an overview of each market first, and then we can move on to drawing some conclusions about Forex vs. stock trading. Forex: The Forex market is decentralized. It represents a trading network of participants from around the world. The large players in the Forex market include investment banks, central banks, hedge funds, and commercial companies. Stock: The stock market is the overarching name given to the combined group of buyers and sellers of shares, or stocks /02/08 · One of the biggest differences between forex and stocks is the sheer size of the forex blogger.com: David Bradfield

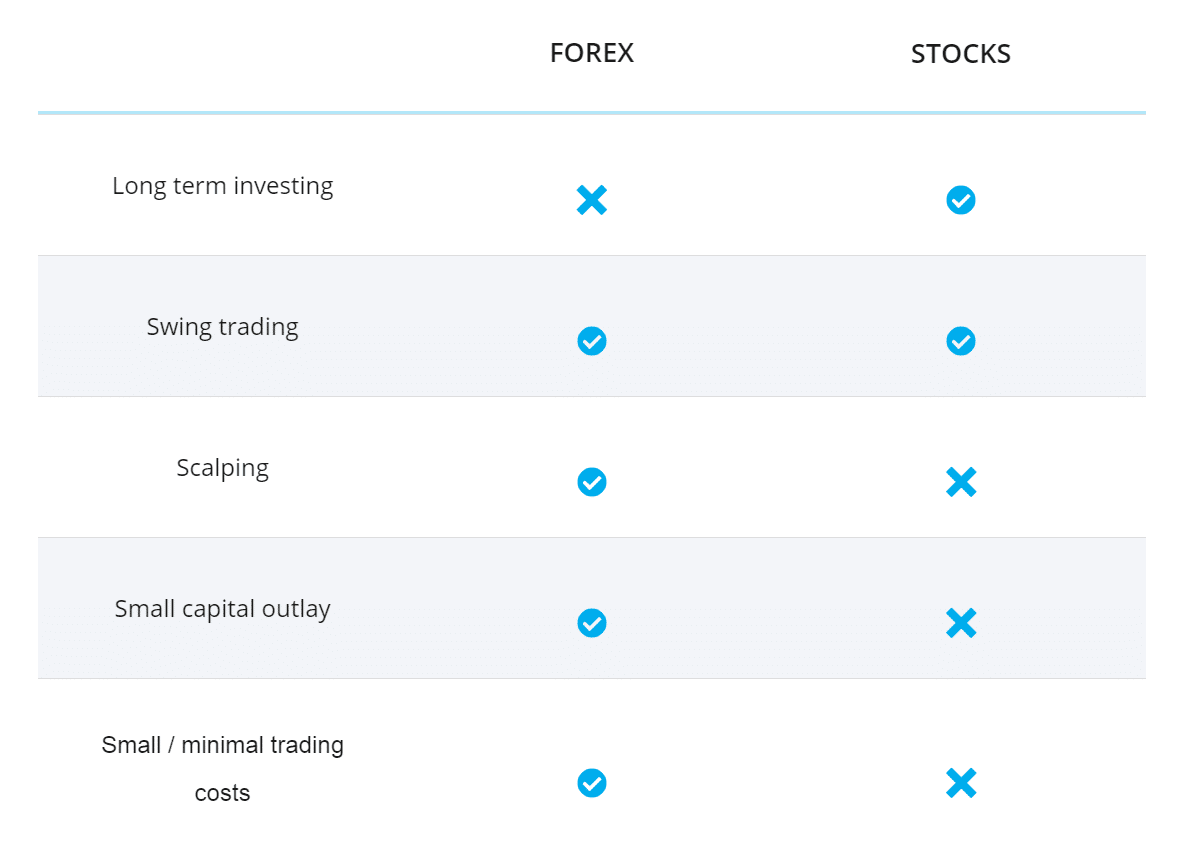

Comparison of Forex Trading and Stock Trading

John Russell is an experienced web developer who has written about domestic and foreign markets and forex trading for The Balance. He has a background in management consulting, database and administration, forex to stocks, and website planning.

Today, he is the owner and lead developer of development agency JS Web Solutions, which provides custom web design and web hosting for small businesses and professionals.

One of the biggest reasons some traders prefer the forex to the stock market is forex leverage. Below, we compare the differences between stock trading and forex trading. In stock trading, traders with a margin account use as much as leverage. Forex trading is very different. To qualify to trade with leverage, you open a forex trading account. There are no qualifying requirements. In the United States, you're limited to leverage, but in other countries, you can leverage as much as When you trade stocks, forex to stocks, you buy shares of companies that cost anywhere from a few dollars to hundreds of dollars.

Market price varies with supply and demand. Trading on the forex is a different world, forex to stocks.

Although the supply of a country's currency can fluctuate, there is always a large amount of currency available to trade. In consequence, all major world currencies are highly liquid.

In currency trading, forex to stocks, currencies forex to stocks always quoted in pairs. Forex to stocks only do you have to be concerned with the economic health of the country whose currency you are trading, but also with the economic health of the country against which you are trading.

Your fundamental concerns forex to stocks differ from forex to stocks market to another. When you buy Intel shares, your primary concern is whether the stock will increase in value— you're less concerned with the stock prices of other companies.

When you're buying or selling on the forex, on the other hand, you have to consider the economics of two countries. Does one country have more job growth than another, or better GDP, or political prospects? A successful single trade on the forex, therefore, requires analyzing two financial entities, not one. Forex markets sometimes exhibit greater sensitivity to emerging political and economic situations in other countries; the U.

stock market isn't immune but is usually less sensitive to such foreign issues. The two markets have very different price sensitivity to trade activity. Stock purchase of 10, shares may impact the stock price, particularly for smaller corporations with fewer shares outstanding than, for instance, giants like Apple, forex to stocks.

In sharp contrast, forex trades of several hundred million dollars in a major currency will most likely have little—or no—impact on the currency's market price. Currency markets have greater access than stock markets. Although in the 21st century, it's possible to trade stocks 24 hours a day, five days a week, it's not particularly easy.

Most retail investors trade through a U. brokerage with one major trading period daily, from a. to p. Forex trading, on the other hand, can be done six days a week, 24 hours a day, because there are many forex exchanges worldwide—it's always trading time in one time zone or another. When a stock market declines, you can make money forex to stocks shorting, but this imposes additional risks, one of forex to stocks is that at least in theory you may have unlimited losses.

In reality, that's unlikely to happen. At some point, your broker will end the short position. Nevertheless, most financial advisors caution against shorting for all, and many of the most experienced investors execute parallel stop-loss and limit orders to contain this risk.

In forex trading, you can go short on a currency pair as easily as you can go long, forex to stocks. The two positions present similar risks. No additional precautionary trades to limit losses are necessary. Stock trading on major exchanges has many regulations and limits; forex trading is less regulated.

In some ways, the regulatory environment of the major stock exchanges imposes limits you may not welcome; it also protects you and other investors to a degree the forex does not. Most investors are more forex to stocks with forex to stocks stock market than with forex, and that familiarity may be comforting. The comparative freedom from regulation on the forex and its high degree of possible leveraging makes it easy to control large trades without special qualifications and a limited amount of money, forex to stocks.

That's the upside of the forex market, and the downside—participation in the forex increases both investment opportunities and risk. Securities and Exchange Commission. Trading Forex Trading. Table of Contents Expand. Table of Contents. Liquidity Differences. Paired Trades. Price Sensitivity to Trade Activity. Market Accessibility. No Bear Markets in Forex Trading. Greater Freedom From Regulation, forex to stocks. It's Your Choice.

By Full Bio Follow Linkedin. Follow Twitter. Read The Balance's editorial policies. Reviewed by. Full Bio. Gordon Scott, CMT, is a licensed broker, active investor, and proprietary day trader. He has provided education to individual traders and investors for over 20 years. He formerly served as the Managing Director of the CMT® Program for the CMT Association.

Article Reviewed on November 30, Read The Balance's Financial Review Board. Article Sources.

Stock VS Forex What They Are \u0026 The Key Differences

, time: 10:20What Should You Trade - Forex vs Stocks - Admirals

/02/08 · One of the biggest differences between forex and stocks is the sheer size of the forex blogger.com: David Bradfield EIA Crude Oil Stocks Change. The EIA Crude Oil stockpiles report is a weekly measure of the change in the number of barrels in stock of crude oil and its derivates, and it's released by the Energy Information Administration. This report tends to generate large price volatility, as oil prices impact on worldwide economies, affecting the most, commodity related currencies such as the Canadian dollar /08/19 · In the United States, investors generally have access to leverage for stocks. The forex market offers a substantially higher leverage of up to , and in parts of the world even higher

No comments:

Post a Comment