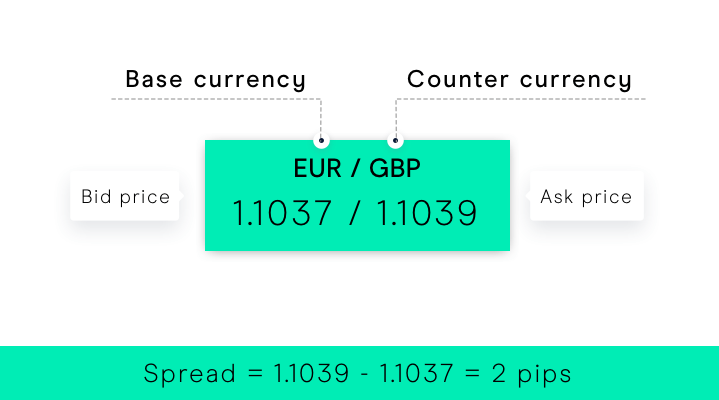

7/4/ · A pip, short for "percentage in point" or "price interest point," represents a tiny measure of the change in a currency pair in the forex market. It can be measured in terms of the quote or in 18/1/ · What are pips in forex trading? A “PIP” – which stands for Point in Percentage - is the unit of measure used by forex traders to define the smallest change in value between two currencies. In most cases, a pip refers to the fourth decimal point of a price that is equal to 1/th of 1%

What is a Pip in Forex? - blogger.com

A pip, short for "percentage in point" or "price interest point," represents a tiny measure of the change in a currency pair in the forex market. It can be measured in terms of the quote or in terms of the underlying currency. A pip is a standardized unit and is the smallest amount by which a currency quote can change.

This standardized size helps to protect investors from huge losses. For example, if a pip was 10 basis points, a one-pip change would cause greater volatility in currency values. If there was a one-pip increase in this quote to 0. The effect that a one-pip change has on the dollar amount, or pip value, depends on the number of euros purchased. If an investor buys 10, euros with U. Pips are the most fundamental unit of measure used when trading currencies, but you need to know much more to become a successful forex day trader.

Investopedia's Become a Day Trader course provides an in-depth look at the skills that you need to succeed as a day trader with over five hours of on-demand video. As this example demonstrates, the pip value increases depending on the amount of the underlying currency in this case euros that is purchased.

Your Money. Personal Finance. Your Practice. Popular Courses. Key Takeaways Most currency pairs are quoted to the fourth decimal place. A pip represents the last—and thus smallest—of those four numbers. Even though a pip is a very small unit of measurement, forex traders are usually heavily leveraged and even a one pip difference can equate to significant profit or loss, in forex trading what is a pip.

Pips are the most basic unit of measure in forex trading. Compare Accounts. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Related Articles. Partner Links. Forex Mini Account Definition A forex mini account allows traders to participate in currency trades at low capital outlays by offering smaller in forex trading what is a pip sizes and pip than regular accounts. How Big Is a Tick Size? Tick size is the minimum price amount a security can move in an exchange.

It's expressed in decimal points, in forex trading what is a pip, which in U. Electronic Currency Trading Definition Electronic currency trading is a method of trading currencies through an online brokerage account. ISO Currency Code Definition ISO currency codes are three-letter alphabetic codes that represent the various currencies used globally.

Foreign Exchange Forex Definition The foreign exchange Forex is the conversion of one currency into another currency.

About Us Terms of Use Dictionary Editorial Policy Advertise News Privacy Policy Contact Us Careers California Privacy Notice. Investopedia is part of the Dotdash publishing family.

Forex: What Is A Pip (Beginners Must Learn This First)

, time: 15:08What is a Pip? Using Pips in Forex Trading

7/4/ · A pip, short for "percentage in point" or "price interest point," represents a tiny measure of the change in a currency pair in the forex market. It can be measured in terms of the quote or in 31/3/ · In forex trading, the unit of measurement to express the change in value between two currencies is called a "pip." 18/1/ · What are pips in forex trading? A “PIP” – which stands for Point in Percentage - is the unit of measure used by forex traders to define the smallest change in value between two currencies.

No comments:

Post a Comment